February is about to end, with the last trading day as the most important event day from policy perspective. As the entire finance bill gets digested, real trend will emerge not on the budget day but later in the next month.

So what has March looked in terms of historical returns?

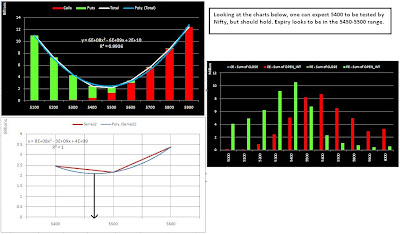

As the chart says, apart from 2008, post budget months have been generally good in recent times.

But another important thing to note is that generally March has been an opposite return month. The years highlighted in green are those which saw this phenomena, and they are far too many to be ignored. All last four years have seen this happen. Looks like budget is a key reversal event! Nifty ended Jan around 5500, if we don't get a 200 point rally tomorrow (chances are we wont!) we will be ending Feb down, so expectation of a March closing with gains would be higher!

Nothing great can be pointed out from the Top chart except that March generally starts strong, shows weakness after first week and then again pick up steam in later part of the month.

How will March 2011 treat Nifty will finally depend on how local and global cues are.

Nifty is clearly weak and any bad news can weaken it more.

Though the supports are near and strong, but the breach of them will create panics galore!