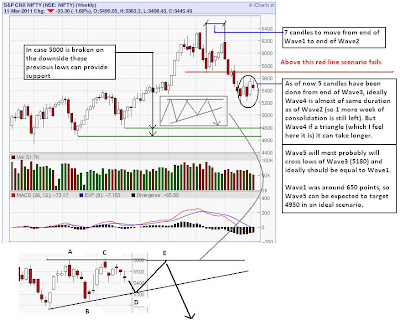

Now that our preferred wave count has been violated, as the current up-move has gone past 5690, the possibility of this being a wave 4 no longer exists. So how do we adjust to the new possibilities that has open up.

When a downswing ends in 3 waves, the most obvious (and most bullish) next phase that comes in mind is a 5 wave up impulse. Though I cannot totally rule out a 5 wave impulsive move up from 5180, the possibility of it is very low. The reason being the movement looks very corrective in nature. (Details later)

The next probability what we can think of is, that the current leg up is wave 2 of 3, that is wave 3 is sub dividing here and if correct it would be the most bearish count one can think of.

The other possibility can be, that the current wave is a corrective wave in an overall corrective pattern. Mostly wave B of ABC (A in 3 waves, B in 3 waves and C in 5 waves) or wave X of a double zig zag (ABC-X-ABC).

So we see that, there are numerous routes that Nifty can take from here, once the simplest count got violated. We need to see more aspects (Volume, MACD etc) to triangulate the next most likely path.

Just something to ponder over:

When a downswing ends in 3 waves, the most obvious (and most bullish) next phase that comes in mind is a 5 wave up impulse. Though I cannot totally rule out a 5 wave impulsive move up from 5180, the possibility of it is very low. The reason being the movement looks very corrective in nature. (Details later)

The next probability what we can think of is, that the current leg up is wave 2 of 3, that is wave 3 is sub dividing here and if correct it would be the most bearish count one can think of.

The other possibility can be, that the current wave is a corrective wave in an overall corrective pattern. Mostly wave B of ABC (A in 3 waves, B in 3 waves and C in 5 waves) or wave X of a double zig zag (ABC-X-ABC).

So we see that, there are numerous routes that Nifty can take from here, once the simplest count got violated. We need to see more aspects (Volume, MACD etc) to triangulate the next most likely path.

Just something to ponder over: