29 December 2010

26 December 2010

Predicting Large Movements

I did some tests to find out what trading pattern precedes large moves, both up and down. So I checked for trading action of previous 5 days for all corrections and rallies over 5%. Let me call them "Big Days". Got some interesting results the summary of which I am pasting below in the table.

First check the bottom table, which says that since July 1990, the average "total" movement of 5 days is over 6% and average "actual" movement is about 0.4%. "Total" here is defined as absolute movement, to capture up and down magnitude both. "Actual" is just the simple net movement for each 5 day block.

Now check the above 2 tables. The top one is for rallies over 5% and bottom for corrections over 5%. What is interesting to see is for both criteria we get an average total of over 12% and average actual of just under -2%! Also could be seen that before such a big movement volatility tends to be double as compared to an average day.

Amazing find is though the actual movement is generally around 0.4%, big moves on both sides come when we are net down (around 2% on an average) in the past 5 trading sessions! So its a tricky situation when market is very volatile and significantly down, as either the downtrend can accelerate or there can be a strong rebound!

The average total movement is another quite interesting find, as it shows that once the volatility is high, (you get big movements same or both sides) there is higher chance that the volatility may carry on for some more time. So I am sure if we plot these big moves in a timeline we should see them in clusters.

There are 60 odd times when we have got 5% or more movement on up and down side in 4900 days. We can say roughly in 80 trading days (3.5-4 months) we should expect one 5% up and one 5% down move day, but as these days tend to be clustered, there should be expectations of more when one occurs. It would be great to track these developments real time, lets wait for our "Big Days".

First check the bottom table, which says that since July 1990, the average "total" movement of 5 days is over 6% and average "actual" movement is about 0.4%. "Total" here is defined as absolute movement, to capture up and down magnitude both. "Actual" is just the simple net movement for each 5 day block.

Now check the above 2 tables. The top one is for rallies over 5% and bottom for corrections over 5%. What is interesting to see is for both criteria we get an average total of over 12% and average actual of just under -2%! Also could be seen that before such a big movement volatility tends to be double as compared to an average day.

Amazing find is though the actual movement is generally around 0.4%, big moves on both sides come when we are net down (around 2% on an average) in the past 5 trading sessions! So its a tricky situation when market is very volatile and significantly down, as either the downtrend can accelerate or there can be a strong rebound!

The average total movement is another quite interesting find, as it shows that once the volatility is high, (you get big movements same or both sides) there is higher chance that the volatility may carry on for some more time. So I am sure if we plot these big moves in a timeline we should see them in clusters.

There are 60 odd times when we have got 5% or more movement on up and down side in 4900 days. We can say roughly in 80 trading days (3.5-4 months) we should expect one 5% up and one 5% down move day, but as these days tend to be clustered, there should be expectations of more when one occurs. It would be great to track these developments real time, lets wait for our "Big Days".

25 December 2010

Breadth Indicator : Week Ending 24 Dec 2010

Gradual improvement in the breadth could be seen when compared to closing of last week. Volumes have been tepid to say the best. Peak has shifted from -60% to -50%, still 137 stocks are trading below their average price and 45 above it.

Nifty : Mean Reversion?

I have always believed that market is like an elastic and rarely settles down at fair value. In bull market we see market extending much higher than fair value and in bear markets it goes much below it. Here comes the universal theory of mean reversion. Which means that in future prices should be coming back to mean.

Ideally chartists use 200 day moving average as a long term mean, and as long as prices are above it, the bull market is said to be ON (in bull markets prices tend to correct to 200 day moving average and then bounce back). If prices fall below it and sustain below it, its the start of a bear market, and theoretically we can say that prices should keep falling and corrective rallies should be limited to the 200 day moving average. But this never happens we see prices cut through this average then bounce to new highs, at times we see prices cutting it through several times before emerging with same or reversed trend and at times there is literally no value given to this average.

One thing what we definitely can say by looking at price and 200 DMA is whether a bull or a bear market is extended. If we feel its extended, we can also start to have a feeling that there are chances of reversion to mean. Lets see the below chart, the upper chart shows percentage gap between price and 200 DMA of Nifty and the lower shows Nifty.

There are a few observation which I want to point out. Firstly with the exception of rally in first half of 1992, 60% has been the upper limit of extension of prices from 200dma. Its more occasionally under 40%. So we see how reverting to mean works in Nifty. In bear markets its more generally -20% with the exception of 2008 where prices fell below -40%.

Though we have not had any significant bear market apart from 2008, we see that in bull market 200dma is respected. I personally believe that we are in a larger bull market from 1998, and within that we are had 2 bear phases 2000-03 and 2008. See how well 200dma is protected from 1998-2000 rally (minor glitch in 2004), from 2003 to 2008 rally and from 2009 till now.

Another observation would be the fact that the bottoms that we have see till now are coinciding with the extremes, though tops are more generally seen after an extreme! (check the chart below). Which goes well with the saying that bottoms are events and tops are process. The last thing I will point is we are kind of in a Top formation pattern as per this chart. Anymore interesting observations are welcome!

Ideally chartists use 200 day moving average as a long term mean, and as long as prices are above it, the bull market is said to be ON (in bull markets prices tend to correct to 200 day moving average and then bounce back). If prices fall below it and sustain below it, its the start of a bear market, and theoretically we can say that prices should keep falling and corrective rallies should be limited to the 200 day moving average. But this never happens we see prices cut through this average then bounce to new highs, at times we see prices cutting it through several times before emerging with same or reversed trend and at times there is literally no value given to this average.

One thing what we definitely can say by looking at price and 200 DMA is whether a bull or a bear market is extended. If we feel its extended, we can also start to have a feeling that there are chances of reversion to mean. Lets see the below chart, the upper chart shows percentage gap between price and 200 DMA of Nifty and the lower shows Nifty.

There are a few observation which I want to point out. Firstly with the exception of rally in first half of 1992, 60% has been the upper limit of extension of prices from 200dma. Its more occasionally under 40%. So we see how reverting to mean works in Nifty. In bear markets its more generally -20% with the exception of 2008 where prices fell below -40%.

Though we have not had any significant bear market apart from 2008, we see that in bull market 200dma is respected. I personally believe that we are in a larger bull market from 1998, and within that we are had 2 bear phases 2000-03 and 2008. See how well 200dma is protected from 1998-2000 rally (minor glitch in 2004), from 2003 to 2008 rally and from 2009 till now.

Another observation would be the fact that the bottoms that we have see till now are coinciding with the extremes, though tops are more generally seen after an extreme! (check the chart below). Which goes well with the saying that bottoms are events and tops are process. The last thing I will point is we are kind of in a Top formation pattern as per this chart. Anymore interesting observations are welcome!

22 December 2010

Nifty : 5 day pattern matching [12/22/2010]

I have tried to seek information from history using past Nifty data. Wanted to post something on it but never had enough material to talk about. Looks like I got something after todays Nifty's close! I have attempted to match last 5 day closing pattern with previous closings and if there was any match (we can hardly expect exact match) I check what happened the following 5 days.

So what I have done is rounded each days closing to the nearest percentage and then searched for similar 5 day pattern. So after today's closing of 0%, I get a sequence of -1,1,0,1 & 0 for the last 5 days. And when I looked back I got 7 instances when Nifty closed in a similar pattern. And to see what happened the next 5 days in all the instances check the table below.

As you can see, the next 5 days have been very lethargic, especially when you consider Nifty to be a higher beta market. We get 2 instances of no net movement in next 5 days, 3 instances of 1% movement, 1 of 3% and 1 of 4% movement. Clearly looks like this type of pattern is generally found during consolidation period.

Also see that there is not a single day when the movement was beyond 1%. When you include the 5 preceding days we get 10 days during which Nifty has not moved more than 1%, which for me is pretty astonishing!

What I can conclude by looking at this data, is that we may be in for some more consolidation, lets see if this kind of analysis helps getting any idea as to what future beholds.

So what I have done is rounded each days closing to the nearest percentage and then searched for similar 5 day pattern. So after today's closing of 0%, I get a sequence of -1,1,0,1 & 0 for the last 5 days. And when I looked back I got 7 instances when Nifty closed in a similar pattern. And to see what happened the next 5 days in all the instances check the table below.

As you can see, the next 5 days have been very lethargic, especially when you consider Nifty to be a higher beta market. We get 2 instances of no net movement in next 5 days, 3 instances of 1% movement, 1 of 3% and 1 of 4% movement. Clearly looks like this type of pattern is generally found during consolidation period.

Also see that there is not a single day when the movement was beyond 1%. When you include the 5 preceding days we get 10 days during which Nifty has not moved more than 1%, which for me is pretty astonishing!

What I can conclude by looking at this data, is that we may be in for some more consolidation, lets see if this kind of analysis helps getting any idea as to what future beholds.

21 December 2010

Seasonal Effect : December Vol 2

The below table shows that last few days of the year has not been really "dull" as it is claimed to be. Though there has not been large movements we can see some good movements which cannot be said to be completely dislocated with the entire years performance. Check the data and you see why I am completely against the thought that holiday period is devoid of interest to a trader!

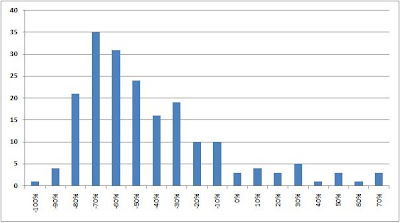

The below charts show the volume distribution since 1997. December volume average also has been at par with the entire year and at times even crosses the yearly average. Concerning factor is the decline of volumes (entire year) from 2009 into 2010.

The below charts show the volume distribution since 1997. December volume average also has been at par with the entire year and at times even crosses the yearly average. Concerning factor is the decline of volumes (entire year) from 2009 into 2010.

19 December 2010

Market the Timing !

Some stats, more for fun than anything else! All the data is from July 1990 for Nifty.

Never knew after February (budget rally), it is December that has given the max return! Also what is it about Wednesdays?!

Never knew after February (budget rally), it is December that has given the max return! Also what is it about Wednesdays?!

Seasonal Effect : December

Lets check out Nifty's performance for the December months since 1990. As it can be seen that Santa Claus has been showering gifts to market participants as Nifty's average return since 1990 to 2009 has been just under 4%!

In 2010 till now Nifty has gained 1.5% and looks set for some more. So I would rather disagree with the theory that market participants tend to book some profits and relax to enjoy the vacations! There is something, maybe "portfolio churning" or maybe just festive mood that forces people to BUY! Need to check why 1990 and 1994 had a bad December.

If we were to believe history we are in for some more rally, but is it ever so easy in Markets?

********************************************************************************

In 2010 till now Nifty has gained 1.5% and looks set for some more. So I would rather disagree with the theory that market participants tend to book some profits and relax to enjoy the vacations! There is something, maybe "portfolio churning" or maybe just festive mood that forces people to BUY! Need to check why 1990 and 1994 had a bad December.

If we were to believe history we are in for some more rally, but is it ever so easy in Markets?

********************************************************************************

Nifty Closing : An Indicator?

As we know most important periods of a trading day is the beginning and the end. Many intra day trading strategies are based on price action of the first hour. And many swing trading ideas come from what level a counter holds at the end of the day. Not that the middle period is not important, but it is generally seen big order flows come during the early and late periods. Also big players and longer term investors do their trades during the late session as volumes are relatively thicker.

So how can we identify these late players who trade big and are also indicator of a trend to continue or reverse. I have tried this using difference between closing price and weighted average price of each day. If we have a closing higher than the weighted average of the day, we can say that much more buying has been done during the latter part of the day, where we expect big players to have participated. Similarly if the closing came below the weighted average, we can say strong selling came later. It can also be looked as if these big players' trades trumped the more menial day traders!

Lets see the above chart for some confirmation. The chart plots Nifty Futures closing along with 10 day SMA of the difference of closing and weighted average price. We can see how the red line after making a "Top" almost along with Nifty starts sliding down and so does the Nifty! Also note how this indicator bottoms along with Nifty and after that starts rising rapidly, indicating buying pressure (closing above weighted average price of whole day).

Other observation, I can make is that though the Nifty price has not risen dramatically the indicator has made a new recent high. It can be either the start of a new uptrend, when big players latching on opportunities to buy low come and spike the prices higher at the end of day or short covering when seeing the prices not falling shorts get covered. Whatever be the reason this is positive for the index. We need to carefully track this going forward to get an idea whether this is genuine buying or just some impatient bears covering short, which when ends will pull the Nifty lower again.

I am also adding the same chart for Bank Nifty and Reliance, the trend can be seen here as well.

So how can we identify these late players who trade big and are also indicator of a trend to continue or reverse. I have tried this using difference between closing price and weighted average price of each day. If we have a closing higher than the weighted average of the day, we can say that much more buying has been done during the latter part of the day, where we expect big players to have participated. Similarly if the closing came below the weighted average, we can say strong selling came later. It can also be looked as if these big players' trades trumped the more menial day traders!

Lets see the above chart for some confirmation. The chart plots Nifty Futures closing along with 10 day SMA of the difference of closing and weighted average price. We can see how the red line after making a "Top" almost along with Nifty starts sliding down and so does the Nifty! Also note how this indicator bottoms along with Nifty and after that starts rising rapidly, indicating buying pressure (closing above weighted average price of whole day).

Other observation, I can make is that though the Nifty price has not risen dramatically the indicator has made a new recent high. It can be either the start of a new uptrend, when big players latching on opportunities to buy low come and spike the prices higher at the end of day or short covering when seeing the prices not falling shorts get covered. Whatever be the reason this is positive for the index. We need to carefully track this going forward to get an idea whether this is genuine buying or just some impatient bears covering short, which when ends will pull the Nifty lower again.

I am also adding the same chart for Bank Nifty and Reliance, the trend can be seen here as well.

17 December 2010

Nifty : Golden Comparison

Everyone of us know that money can be printed at a much faster rate than can Gold be pumped into the system and here comes the importance of Gold. Warren Buffett made a mockery of Gold as an investment as it has no industrial use and do not create any value. There are "smartys" on the other side of the table as well, like Jim Rogers who cannot get enough of gold. Whoever is right here, but in times of hyperinflation one knows what Gold's real worth is! There no doubt, is a considerable unanimity that Gold is the real currency.

Keeping that in mind many chartists, show chart of S&P 500 in terms of Gold, and if you look at the chart below, you can see what enormous damage has been done to the Index in 3 years.

I would like to show the same thing except that it will be Nifty in terms of Gold priced in dollar.

Though we have just missed crossing an all time high by few points, check how we do when we compare it with Gold. Earlier high was 7.25 in early 2008, we managed to get to a high of just over 5 and that too in September 2009 and since then we have moved sideways to lower. When Nifty was over 6300 in November this chart was at 4.5, which means still almost 35% lower!

So actually Nifty in real terms even after this big rally back to old highs have gained only apparent value! We feel we are "richer" or back to how "rich" we were! But actually investors have lost real value. Now as per one of my earlier post, I recall Rupee was around 39 per dollar in Jan 2008 and in Nov 2010 it was around 44 to a dollar. Which again means that Rupee has weakened around 12.5% against the dollar during the period Jan 2008 to Nov 2010. Now doesn't it mean that real value for Indian investors of Nifty in terms of Gold is even lower. It roughly comes to around 40%!

So do the math and realize that we are nowhere near the highs, we are just feeling good about it!

Month to Date Sectoral Performance

Nifty closed at 5961 on Dec 1 and at 5949 on Dec 16, a marginal change of -12 points. But as we know the main damage has been done to the breadth of the market.

As you can see below all sectors except for IT and Oil & Gas has lost value. Oil & Gas is neutral very much like Nifty. Financial stocks have been battered the most.

Among the other major sectors we see how Realty, Infrastructure, Telecom and even Auto has shown considerable weakness.

Traditional defensives like Health Care and FMCG hold their stature, though I would have expected better performance, when you consider that Nifty has not lost anything.

If we have to rally from here, sectoral leadership is required, which we have not seen yet. There is only defensive buying of IT due to expectations of Rupee to fall more and under owned Oil & Gas stocks. Though we are definitely seeing leadership on the downside!! Financials were definitely over owned and had a tremendous rally, Realty, Infrastructure and Telecom never were the "Hot" stocks and are seeing more beating.

I am quite surprised to see Materials stocks quiet resilient to the selling. Maybe they will lead the next round of selling if buying does not emerge anywhere!

As you can see below all sectors except for IT and Oil & Gas has lost value. Oil & Gas is neutral very much like Nifty. Financial stocks have been battered the most.

Among the other major sectors we see how Realty, Infrastructure, Telecom and even Auto has shown considerable weakness.

Traditional defensives like Health Care and FMCG hold their stature, though I would have expected better performance, when you consider that Nifty has not lost anything.

If we have to rally from here, sectoral leadership is required, which we have not seen yet. There is only defensive buying of IT due to expectations of Rupee to fall more and under owned Oil & Gas stocks. Though we are definitely seeing leadership on the downside!! Financials were definitely over owned and had a tremendous rally, Realty, Infrastructure and Telecom never were the "Hot" stocks and are seeing more beating.

I am quite surprised to see Materials stocks quiet resilient to the selling. Maybe they will lead the next round of selling if buying does not emerge anywhere!

Breadth Indicator : Week Ending 17 Dec 2010

With some amount of short covering we saw Nifty closing higher for the week. Breadth has not improved much, I can recall peak at -70% which has crept to -60%, Their has been pocket of strength, especially IT which actually have not seen any correction.

With 151 stocks trading below their average and only 34 above it, hard work is still left to be done by the bulls.

12 December 2010

11 December 2010

Nifty : H&S

Some technical patterns come to you right away when you look at charts. You don't need to find them. A head and shoulder pattern is among those. It is the most common reversal pattern and hence widely studied and talked about.

As per Stockcharts.com:

The head and shoulders pattern is one of the most common reversal formations. It is important to remember that it occurs after an uptrend and usually marks a major trend reversal when complete. While it is preferable that the left and right shoulders be symmetrical, it is not an absolute requirement. They can be different widths as well as different heights. Identification of neckline support and volume confirmation on the break can be the most critical factors. The support break indicates a new willingness to sell at lower prices. Lower prices combined with an increase in volume indicate an increase in supply. The combination can be lethal, and sometimes, there is no second chance return to the support break. Measuring the expected length of the decline after the breakout can be helpful, but don't count on it for your ultimate target. As the pattern unfolds over time, other aspects of the technical picture are likely to take precedence.

One wacky thing about a very obvious chart pattern is that almost the entire trading fraternity will recognize it. And then if all of them expect a reversal to happen (in this case which is a head and shoulder pattern) will the reversal happen? If you ask any sentiment and contrarian trader we will be licking his lips to go long if such a situation arise! But we should also agree to the fact that technical analysis is a price and volume based study of traders. So we have a head and shoulder pattern as an important reversal indicator because people tend to behave in a similar manner year after year and trader after trade.

So its very important to check that all other criteria expected for a H&S reversal are met:

(Quoting Stockcharts.com again)

Coming to the potential H&S developing in Nifty shown below. Chances of a test of neckline in coming days should be expected. If that happens we need to be very careful around the neckline as any break of it with goos volume would be threatening the entire upmove from 2250.

As per Stockcharts.com:

The head and shoulders pattern is one of the most common reversal formations. It is important to remember that it occurs after an uptrend and usually marks a major trend reversal when complete. While it is preferable that the left and right shoulders be symmetrical, it is not an absolute requirement. They can be different widths as well as different heights. Identification of neckline support and volume confirmation on the break can be the most critical factors. The support break indicates a new willingness to sell at lower prices. Lower prices combined with an increase in volume indicate an increase in supply. The combination can be lethal, and sometimes, there is no second chance return to the support break. Measuring the expected length of the decline after the breakout can be helpful, but don't count on it for your ultimate target. As the pattern unfolds over time, other aspects of the technical picture are likely to take precedence.

One wacky thing about a very obvious chart pattern is that almost the entire trading fraternity will recognize it. And then if all of them expect a reversal to happen (in this case which is a head and shoulder pattern) will the reversal happen? If you ask any sentiment and contrarian trader we will be licking his lips to go long if such a situation arise! But we should also agree to the fact that technical analysis is a price and volume based study of traders. So we have a head and shoulder pattern as an important reversal indicator because people tend to behave in a similar manner year after year and trader after trade.

So its very important to check that all other criteria expected for a H&S reversal are met:

(Quoting Stockcharts.com again)

- Prior Trend: It is important to establish the existence of a prior uptrend for this to be a reversal pattern. Without a prior uptrend to reverse, there cannot be a Head and Shoulders reversal pattern (or any reversal pattern for that matter).

- Left Shoulder: While in an uptrend, the left shoulder forms a peak that marks the high point of the current trend. After making this peak, a decline ensues to complete the formation of the shoulder (1). The low of the decline usually remains above the trend line, keeping the uptrend intact.

- Head: From the low of the left shoulder, an advance begins that exceeds the previous high and marks the top of the head. After peaking, the low of the subsequent decline marks the second point of the neckline (2). The low of the decline usually breaks the uptrend line, putting the uptrend in jeopardy.

- Right Shoulder: The advance from the low of the head forms the right shoulder. This peak is lower than the head (a lower high) and usually in line with the high of the left shoulder. While symmetry is preferred, sometimes the shoulders can be out of whack. The decline from the peak of the right shoulder should break the neckline.

- Neckline: The neckline forms by connecting low points 1 and 2. Low point 1 marks the end of the left shoulder and the beginning of the head. Low point 2 marks the end of the head and the beginning of the right shoulder. Depending on the relationship between the two low points, the neckline can slope up, slope down or be horizontal. The slope of the neckline will affect the pattern's degree of bearishness: a downward slope is more bearish than an upward slope. Sometimes more than one low point can be used to form the neckline.

- Volume: As the Head and Shoulders pattern unfolds, volume plays an important role in confirmation. Volume can be measured as an indicator (OBV,Chaikin Money Flow) or simply by analyzing volume levels. Ideally, but not always, volume during the advance of the left shoulder should be higher than during the advance of the head. This decrease in volume and the new high of the head, together, serve as a warning sign. The next warning sign comes when volume increases on the decline from the peak of the head. Final confirmation comes when volume further increases during the decline of the right shoulder.

- Neckline Break: The head and shoulders pattern is not complete and the uptrend is not reversed until neckline support is broken. Ideally, this should also occur in a convincing manner, with an expansion in volume.

- Support Turned Resistance: Once support is broken, it is common for this same support level to turn into resistance. Sometimes, but certainly not always, the price will return to the support break, and offer a second chance to sell.

- Price Target: After breaking neckline support, the projected price decline is found by measuring the distance from the neckline to the top of the head. This distance is then subtracted from the neckline to reach a price target. Any price target should serve as a rough guide, and other factors should be considered as well. These factors might include previous support levels, Fibonacci retracements, or long-term moving averages.

Coming to the potential H&S developing in Nifty shown below. Chances of a test of neckline in coming days should be expected. If that happens we need to be very careful around the neckline as any break of it with goos volume would be threatening the entire upmove from 2250.

Breadth Indicator : Week Ending 10 Dec 2010

Above is the distribution of stocks in their respective "deciles". If it is compared to the chart of the week ending Dec 03 we can see a gradual shift in the concentration from -40% to -70%. Nifty after going through a bounce retreated lower.

The only thing to be commented here is that we are seeing more and more stocks getting weaker. The definition of getting weaker here is "trading closer to their lows" in the December series.

The weakest stocks are:

SCI

JINDALSWHL

JSWSTEEL

PANTALOONR

ROLTA

SINTEX

The strongest are:

HCLTECH

DRREDDY

AREVAT&D

TCS

HEXAWARE

INFOSYSTCH

SUNTV

The only thing to be commented here is that we are seeing more and more stocks getting weaker. The definition of getting weaker here is "trading closer to their lows" in the December series.

The weakest stocks are:

SCI

JINDALSWHL

JSWSTEEL

PANTALOONR

ROLTA

SINTEX

The strongest are:

HCLTECH

DRREDDY

AREVAT&D

TCS

HEXAWARE

INFOSYSTCH

SUNTV

Advance - Decline : Leading Nifty Indicator ?

I am using NSE F&O data to try to get find some pattern and get insight on how trading is going on and what can we make out of it. Not necessarily there will be any relation between a metric and the Nifty, but surely we can gauge the sentiment and mood of traders at work!

Lets look at "Advances - Declines" of 200 odd NSE F&O stocks and see what its going through. As the name suggests we take the difference of number of stocks gaining and losing in price and then smooth it out by taking a 5 day simple moving average. This simple construct, gives us an idea as to how many stocks are there where money is flowing in and how many from where the money is flowing out. So a value around 0 would be very neutral and a sign of equal forces on both sides. A positive value favors the bulls and a negative the bears.

The chart above shows how our indicator declines while nifty consolidates above 6000 and then make a valiant attempt to take out 6357, which was and still is an all time high. This attempt failed and the little rise in the 5day moving average of "adv-dec' also gave way to bigger fall. We see here how a negative divergence between nifty and our indicator showed that something was wrong and the rally should not be trusted.

Now check the period when this indicator made a new low, while Nifty gained negative momentum during the fall. Our indicator stopped making new lows, but Nifty made a new low (a positive divergence here!). Interestingly markets rallied after that though it lost its way below 6100.

Now check the action of last few days, our indicator has made a new low on 9th December and then bounced taking Nifty along with it. If this indicator has to be believed we should see Nifty making new low in coming days.

This indicator that I illustrated is very much in line with Mclean indicator, though much simpler. The concept behind this indicator is that if the market is weakening overall it would be first noticed on the broader market then on the index, where more blue chip are concentrated. This also reflects the common sentiment of moving into stronger companies (which generally are in index) during periods of over-valuation and caution.

I will be checking if this really works or are these observations mere coincidence!

Lets look at "Advances - Declines" of 200 odd NSE F&O stocks and see what its going through. As the name suggests we take the difference of number of stocks gaining and losing in price and then smooth it out by taking a 5 day simple moving average. This simple construct, gives us an idea as to how many stocks are there where money is flowing in and how many from where the money is flowing out. So a value around 0 would be very neutral and a sign of equal forces on both sides. A positive value favors the bulls and a negative the bears.

The chart above shows how our indicator declines while nifty consolidates above 6000 and then make a valiant attempt to take out 6357, which was and still is an all time high. This attempt failed and the little rise in the 5day moving average of "adv-dec' also gave way to bigger fall. We see here how a negative divergence between nifty and our indicator showed that something was wrong and the rally should not be trusted.

Now check the period when this indicator made a new low, while Nifty gained negative momentum during the fall. Our indicator stopped making new lows, but Nifty made a new low (a positive divergence here!). Interestingly markets rallied after that though it lost its way below 6100.

Now check the action of last few days, our indicator has made a new low on 9th December and then bounced taking Nifty along with it. If this indicator has to be believed we should see Nifty making new low in coming days.

This indicator that I illustrated is very much in line with Mclean indicator, though much simpler. The concept behind this indicator is that if the market is weakening overall it would be first noticed on the broader market then on the index, where more blue chip are concentrated. This also reflects the common sentiment of moving into stronger companies (which generally are in index) during periods of over-valuation and caution.

I will be checking if this really works or are these observations mere coincidence!

07 December 2010

Chris Martenon interviews Charles Hugh Smith

1. Of the many forces at play that you write about within the economy, society, and politics - which ones do you see as the most defining for the future? How do you expect things to unfold?

CHS: Clearly, demographics and Peak Oil are forces which cannot be massaged away by policy tweaks or financial engineering. I think the exhaustion of Global Neoliberal Capitalism and State Capitalism is apparent, as is the bankruptcy of the two ideologies that more or less define our politics. The reliance on expansion of credit and State power is a dynamic with only unhappy endings.There are also structural end-games such as Baumol's Disease at work: the inefficient sectors of the economy end up dominating the national income. Services such as healthcare, education and the Armed Forces become more productive at much slower rates than the overall economy. Looking ahead, the Empire (the hundreds of overseas military installations, the diplomatic and financial reach into every nook and cranny of the planet, etc.), healthcare and other entitlements will require most of the national income. That is an unsustainable trajectory, especially as Peak Oil/peak everything kicks in.

As readers know, I am intensely interested in dynamics which are subtle and not quantifiable. Since they can't be quantified, they are generally ignored. Yet they are very real, even though we may not even be conscious of them.

The reliance on propaganda, for instance, has become so pervasive that the notions of truth and honesty have been hollowed out. Nobody expects the President or Ben Bernanke to speak honestly, as the truth would shatter an increasingly fragile status quo. But this reliance on artifice, half-truths and propaganda has a cost; people are losing faith in government , in all levels of authority, and in the Mainstream Media—and for good reason.

The marketing obsession with instant gratification and self-glorification has led to a culture of what I call permanent adolescence. Politicians who promise a pain-free continuation of the status quo are rewarded by re-election, and those who speak of sacrifice are punished. An unhealthy dependence on the State to organize and fund everything manifests in a peculiar split-personality disorder: people want their entitlement check and their corporate welfare, yet they rail against the State's increasing power. You can't have it both ways, but the adolescent response is to whine and cajole Mom and Dad (or the State) for more allowance and more “freedom.” But freedom without responsibility and accountability is not really freedom; it's simply an extended childhood.

2. You’ve written recently that you expect us to enter deflation because the amount of QE dollars pale in comparison to the amount of bad debt still to be destroyed. How can you be so sure? Why should anyone trust the dollar as a viable long term unit of wealth preservation in an environment where the natural checks & balances of the interest rate mechanism is being subverted?

CHS: Can I please have a softball question instead?The words “deflation” and “inflation” are so loaded nowadays that I try to substitute “purchasing power” whenever possible. Conceptually, we tend to lump all sorts of things into words which may or may not actually be related. So we have to separate asset deflation/inflation from resource/currency prices.

One way to understand this is to measure everything in terms of what an hour of work can buy, and how much real goods an asset can buy. If you sold your house in 1995, how many barrels of oil could you have bought? How about now?

How many hours of labor did it take in 1975 to buy health insurance? How about now?

This sort of analysis helps us understand that the average household has seen purchasing power stagnate or decline for 35 years, and that capital has seen its purchasing power rise. The Great Housing/Credit Bubble seemed to offer households a chance to “catch up,” and perhaps the lucky few who sold at the top and have been renting since did restore their lost purchasing power. But most households have seen their wealth decline.

There are so many moving parts to value and price that it's very difficult to make sense of deflation and inflation. I start with simple numbers: Americans have collectively seen their assets decline by about $12 trillion since 2007, $6 trillion of which is lost residential home equity. That has effectively destroyed the balance sheet of most homeowners with recent-vintage mortgages.

As interest rates rise and the stock market rolls over along with corporate profits, then another $10 trillion or so of bond and stock equity will evaporate. Given a decline of $20 trillion, then the Fed's expansion of its balance sheet by $2 trillion doesn't seem so mighty or irresistible.

As for the dollar's long-term viability as a store of wealth: there is precious little evidence right now for its long-term future, but the value of a currency is a political process more than a financial one. A currency is a claim on a nation-state's income stream and viability, so if those are devolving then so too will the currency.

Sentiment is so negative on the dollar that I expect the opposite to occur. How could this happen? A political change in 2012 might shift priorities and instill some confidence that the U.S. is actually ready to deal with reality.

That said, assets such as income property, productive land and energy will retain value whether the dollar is destroyed or if it confounds us all by stabilizing. Wealth held in any currency carries intrinsic risk, but over the next few years the dollar may surprise us by strengthening considerably. That would give those holding dollars a golden opportunity to transform paper into real assets which have been depreciated by the global depression.

You make a key point about interest rates being subverted. I suspect that State manipulation can only run so far, and then market forces and asset deflation will kick in. Again, the high-probability catalyst in my view will be the public and political class's loss of faith in the Federal Reserve's manipulations of the economy. I expect 2012 to be a pivotal year.

3. Do you think we as a society/world are going to pull back from the brink of collapse we appear to be teetering on? Or do you think it's more practical to plan for how best to pick up the pieces afterwards?

CHS: There are numerous feedback loops at work and so things rarely proceed in a straight line. Governments will continue creating credit and money in hopes of overcoming the destruction of assets, and nobody knows how long that charade can continue. It may run longer than seems possible, just as the housing bubble ran for three years past what was already an unprecedented top.I lean towards a “defense in depth” approach where we have an A, B and C response. What can we do in present circumstances to increase our resilience and sustainability? That would be A (the simple things like conservation and cutting expenses) and B (harder things, like creating a new income stream or moving closer to your job/source of income). Option C would be a plan of action if things fall apart. Even then, most of us might be better off staying where we are, if we have a social network of support and sharing.

4. There is no shortage of criticism for the mess we find ourselves in. Far more scarce but much more important are solutions. How does the world restore fiscal “soundness” and what needs to be done to set the stage for a rebirth?

CHS: The reliance on credit rather than on capital will have to end, and that means the demise of the credit-based consumer economy run by the Central State and global cartels.The State fiefdoms and corporate cartels have every incentive to maintain the status quo, so change will probably come from unconventional innovations. I'd like to see a private, asset-based global currency arise, for instance. Since it would not be a nation-state's currency, it would be relatively free of political intervention.

I tend to see parallel private-sector structures (opt-in, open-source) as solutions rather than counting on the bold revamping of status quo, Financial Power Elite-dominated structures. The incentives in these dominant structures are all to retain the status quo at all costs. So solutions which don't rely on their approval are more likely to occur.

5. How does the general citizenry take power back from the plutocracy you write about that has amassed a supermajority of wealth and power in the world?

CHS: I think voting against conventional politicos who are indebted to the status quo Power Elites and voting for any politico who dares to speak honestly about power structures and sacrifice is worth a try, as it is essentially cost-free.Voting for third-party candidates seems quixotic but as the public loses faith in the traditional sources of authority then viable third-parties might arise, at least locally.

“Starving the beast” by eliminating debt and financial churn is also a two-fer: it reduces the income streams of the Plutocracy and accumulates capital for households. A society without mortgages or credit cards would also be a society without “too big to fail” banks. Commercial credit of the sort needed for business does not require global investment banks or shadow banking empires.

6. In your book Survival+, you outline strategies concerned individuals can pursue to prepare for a tumultuous future. Can you summarize the key elements of your guidance for those yet to read the book?

CHS: The basic ideas are simple: the political, financial and resource structures of the status quo are unsustainable, and so dependence on the Savior State is not a viable survival strategy. The “new” model is actually an “old” model that has atrophied and been lost: self-reliance, resilience, reciprocity and transparent, opt-in organizations with clear lines of accountability.I spend 2/3 of the book on the critique because I thought it was essential to explain the powerful yet subtle layers of our social conditioning that resist this sort of fundamental transformation: permanent adolescence, the growth of the Global Empire as part of the national identity, the substitution of consumption for productive work, the surrender of autonomy in favor of over-reliance on the Savior State, and the conquest of our politics of experience by marketing and propaganda.

This sort of “soft” conceptual analysis is alien in a culture that is so reliant on quantifying everything, and that is part of the crisis we face.

To give a real-world example: about one-third of the U.S. citizenry is obese and unfit. Extrapolate these trends even a few years and we're told fully half the populace will be at risk of diabetes. The consequences of this are horrific for individuals and society alike.

We know these trends are not good for us, but the majority of people find maintaining their weight and fitness to be essentially impossible tasks. While we are culturally conditioned to blame our own weaknesses for any deficiency in our response, I think social conditioning is the key factor. An economy/society dominated by marketing, instant gratification and a desperate (and highly manufactured) yearning for self-glorification is not a healthy society, and the illness of that society manifests itself in poor mental and physical health.

In effect, our society makes us ill if we “buy into” the marketing and political/financial fantasies.

We can't really fashion self-reliance and a new parallel way of productive living if we're trapped in an interlocking mess of destructive social conditioning.

The “Survival+” approach is an intrinsically hopeful one, because I know it is possible to free ourselves of the social conditioning that leads to ill-health, and to live on a small percentage of the energy we currently consume.

For skeptics who say this is “impossible,” then I turn to the developing world for examples. People in productive, stable societies live quite nicely on a fraction of the energy we consume. The American lifestyle is not inevitable.

7. Every period of history feels unique and special to its inhabitants. Looking back through time, the sorry excesses of empire, maintenance of the status quo by the elites, and financial folly are quite commonplace. What, if anything, actually makes this period of time, troubling as it is, unique or different in the human experience?

CHS: Clearly, Peak Everything and a very fragile system of global supply chains upon which industrial societies are totally dependent are two unique characteristics. All the efficiencies of these global supply chains are based on cheap, abundant oil and political stability. These two requirements are inter-connected, of course; when the U.S. finally stopped shipping oil to Japan in 1940, then the Japanese Empire had no choice but to launch a war of conquest aimed at resources such as Indonesian oil.As political stability and these long supply chains devolve, then nation-states will increasingly have no choice but to expropriate resources nominally owned by corporations located 6,000 miles away. Once the supply chains are broken, then the dependent structures will have to adapt. Those that can't or won't will collapse.

Information itself is a supply chain which is exquisitely vulnerable to disruption.

The other unique factor is the proliferation of disruptive weapons, not just nuclear but biological and cyber weapons. China has every intention of “winning” any potential conflict with the U.S. by disrupting the U.S. military, society and economy via cyber-attacks on our infrastructure and communications. That ability to disrupt an entire nation via fiber-optic cables is new.

On the positive side, we as a species have never had such ubiquitous access to information, and to a global ability to fashion our own networks of sharing and cooperation. It is easier now than ever before to share what “works” and how it 'works” in specific situations.

The potential for open-source, transparent, scalable structures which operate in parallel with nation-states and global cartels is new. In the past, only nation-states and global corporations had the resources to establish these sorts of networks, and they were operated for the express benefit of the Elites at the top of the State and corporations.

What's also new is the widespread access to very powerful technologies. Computers and networks were once only accessible to small circles of specialists. Setting up supply chains or manufacturing were so capital-intensive that only a few organizations could afford to do so. This is still true for certain things such as computer processors, but a wide range of other productive work is now available to a much larger pool of humanity.

Innovative, appropriately scaled and sustainable technologies are not new, but global access to them is new.

8. What formative experiences in your life led you to create a blog like OfTwoMinds.com? What are your goals for the site?

CHS: Since I'd been writing about housing and real estate as a freelance journalist for 15 years, it was a natural progression to push the sort of analysis I could never get published in the Mainstream Media onto the Web.

Writing for the public is something that I started in high school and it's manifested in various ways over the years.

In 1969-70 my good friend Colbert and I started an underground newspaper in Lanai High School. The administration assumed it was published by teachers, which was quite a compliment to a couple of 16-year olds. We printed it on the ILWU's mimeograph machine.

As an activist in the American Friends Service Committee (AFSC) and in our political party (a legal third party) in the 1970s, we had to constantly produce newsletters, leaflets and campaign material, so the process of communicating ideas and defining positions in writing became familiar.

A close friend and I started a print magazine in Berkeley in 1984 called VoltAge, with a focus on technology and culture. It was horrendously expensive to publish a magazine, and I could only fund one issue. But that experience gave me a taste for eclectic media that combines a variety of topics and perspectives under one roof.

Though I wasn't consciously aware of it, I guess those previous experiences gave me the confidence to see oftwominds.com as a platform for a range of ideas and analysis.

Lofty goals can sound awfully pretentious, but alongside that risk is the notion that big goals can inspire us to great things. I have four goals for oftwominds.com:

- Promote serious journalism on the web by presenting issues which the Mainstream Media sidesteps, dismisses or whitewashes

- Encourage an online role for what was once called “public intellectuals,” a category which has atrophied into MSM-approved academic pundits such as Paul Krugman and “entertainer”-type ideologues like Glenn Beck, both of whom parrot simplistic ideologies that are increasingly meaningless.

- Contribute to the ongoing discussion of practical solutions for the interlocking crises we face

- Construct an integrated understanding of the ideas and issues which interest me and my readers.

And when I can't do any of the above, I try to write something mildly interesting.

9. Many leading econobloggers came to the profession via unorthodox paths, but perhaps none so much as you: philosopher, social activist, freelance writer, musician. What about your idiosyncratic background do your attribute your success?

CHS: How the site has gathered such a smart, world-wise readership has been a mystery, and I think the key ingredients that attract people are the two complementary threads which run though my apparently random interests and careers: an interest in the structure of problems, and a desire for a hands-on, practical grasp of how these structures work in the real world.

In our increasingly specialized world, few people seem to bridge the divide between a conceptual understanding and a practical understanding. All the things which have deeply interested me—building, urban planning, music, politics, gardening, health, fiction, journalism and financial analysis— have a conceptual framework that you can learn, but that doesn't mean you can actually build a house, play a chord progression, start a business, write coherently or make a profitable investment.

As we all know, the real world is messy, contingent, and unpredictable. So actually starting and running a small business that does millions of dollars of business is completely different from a pundit's simplistic view from 30,000 feet. That's one reason why the political class of the U.S. is so divorced from reality; they speak glowingly about “small business” with no appreciation for how difficult it has become to start a real-world enterprise.

Since I know about small business from experience, then it's obvious to me that small business is being strangled and will not be hiring millions of new workers.

We all want a coherent explanation of what's unfolding, and we also want practical suggestions on how to adapt. It's difficult to provide both, and the great thing about having a smart readership is that readers educate me about things I don't have any real-world experience in, such as healthcare.

So philosophy and hands-on working knowledge act as a sort of yin-yang unity: both are necessary to understand and navigate the real world.

The basic idea behind philosophy is to think clearly about issues and work from first principles. Even non-linear philosophies such as Taoism have first principles which illuminate and explain the whole.

So my goal in any subject is to establish the first principles or assumptions, and then try to explain how each link in the thesis leads to various conclusions. Rather than accept ideas that are repeated as if they are true, we ask two questions: exactly how does this argument work, and cui bono—who benefits if we accept this as true?

That is also the core of good journalism.

But in addition to journalism—explaining, critiquing, asking questions—we all want and need practical solutions or pathways. I guess I have always been drawn to a hands-on understanding of how things work, and that is the thread which informs oftwominds.com. I think my readership appreciates that practical working knowledge only comes from long practice and a lot of mistakes and setbacks.

Another way of defining these two complementary threads is to look at both as toolboxes. Ideas such as system analysis and evolution are tools which help illuminate the structure beneath the surface, and practical skills—breaking down tasks and gaining mastery one step at a time—give us tools for taking those insights into the real world.

Since I'm very average, and have no connections to wealth or power, I've relied on perseverance and enthusiasm. Maybe that carries over somehow to the blog.

10. What question didn’t we ask, but should have? What’s your answer?

CHS: One such question might be: what are the foundations of my general optimism about the Great Transformation ahead?One is the process of evolution has expanded from the genome to culture and technology. All species must adapt or perish, and individuals have to adapt to changing circumstances. At a system level, there are feedback loops, positive and negative, which mean extrapolating the present into the future is not very accurate. New feedback loops can be added, and the value systems of cultures can also adapt.

Self-criticism and honesty are essential to growth and learning. The American political and financial Elites are committed to maintaining the Status Quo at all costs, even to the point we have now reached that reality is replaced by simulacra.

But other elements of the society are actively questioning the Elites and our social conditioning. They are asking what part their own actions play in supporting and enabling the status quo.

Honesty includes expressing anger, frustration, whining, and all the rest of human emotions. The idea that maintaining a veil of secrecy and stiff-upper lip “everything's fine, shut up and keep your head down” will yield positive results is wrong. That leads to discord, distrust, illness and madness.

The greatest strength of America, or any society, organization or individual, is open, honest self-criticism and questioning. We only change when we have no other choice, and to expect the status quo to adapt without fierce resistance is impractical. So rather than waste energy trying to change those structures doomed to collapse or devolution, we're better off establishing our own networks of support, cooperation and sustainability.

An honest appraisal will lead us to challenge all sorts of assumptions we have made about the nature of work, property, the economy, healthcare, the Central State and much else.

The choices will not always be clear-cut. I will end with a story about my friend

Dexter Cate. Dexter was committed to saving dolphins from being slaughtered, and he'd found no official interest in protecting them.

So he swam out alone, at night, in a raging storm, and slashed the nets trapping hundreds of dolphins that were to be killed the next day. He was imprisoned in Japan for destroying “private property,” that is, the nets.

We all value property rights, but what was more important, the destruction of private property or the lives of the dolphins? The legal system was clear; the dolphins had no standing compared to the nets. Dexter chose otherwise.

What do we really value? Our answers will inform our choices in the transformation ahead.

Thank you for such thoughtful questions, and I hope I haven't put everyone to sleep in answering them.

05 December 2010

Dollar Impact on Nifty

Let me start with the chart itself. We will try to see if there is any connection of the exchange rate on the Indian Markets in short and long term.

The USD-INR weekly chart shown above is from March 2007 till date. Notice how Rupee strengthened till Oct-Nov of that year till 39 but then stabilized while the Nifty kept rallying. Even in January when the mini crash occurred it was well under 40. I personally cannot imagine such a crash in Nifty now without giving the exchange rate any resulting shock. Even a 100 point Nifty movement is accompanied with 30-50 basis points of movement in the exchange rate. How can an 1800 movement point be almost lost in the above chart? In my opinion the stock market and currency game were played in two different fields, also I cannot rule out RBI trying to stabilize the currency by intervening to give some respite to the exporters around that 40 levels before the mini crash in Jan and doing the opposite after it. (As it would have pledged to keep the exchange rate around 40).

But as we know that stock market mini crash was just the beginning and slowly and steadily global risk aversion was developing. After May 2008 Rupee started sliding as FIIs started selling their holding in India and other emerging markets which were considered risky assets as compared to US treasuries. This "sell" emerging market assets gained big momentum around Oct 2008 when Lehmann collapsed. Interestingly though Nifty made its low during this period, the carnage in broader market was still on. Which we see as the Rupee kept falling until it reached 52, almost a 33% fall in just over a year!

Then comes the phase where huge bailouts were announced and the Fed started printing dollars to save the US banks and much more (so dollar started losing value compared to other currencies). Apart from being highly oversold and shooting well below fair value, emerging assets also started looking attractive and since then we are still going strong with the rally in Rupee!

Now lets do some interpretation of this chart. The rally from 39 to 52 clearly looks to be a 5 wave. Also look at how rally from Dec 2008 to Mar 2009 forms a negative divergence, which is a very typical 5th wave property. Also note that the lows of Apr 2010 and Oct 2010 forms a positive divergence. Dollar also have rallied from 44 level, which interestingly is 62% Fibonacci retracement of the entire trend from 39 to 52.

If we look at the long term chart above we can clearly say it is in a long term uptrend. Which kind of makes me believe that the trend should continue. In the above chart see how from 2002-2003 dollar has lost its value while the stocks rallied from Nifty 1200 to 6300! Also note that it looks to be a 3 wave corrective pattern. Putting this in the back of mind I feel we are yet to see another strong rally in dollar compared to rupee which should take it above 52 to say the least.

Now all of know how this rally can impact stock markets. The fact that Rupee is going to weaken is not a concern, but the current structure of the currency market which blatantly says that dollar is a safe haven and emerging markets currencies are risky assets are. If this rally is to come, its going to be only on risk aversion, where all assets apart from Dollar will be painted with the same brush.

Another point to note on the first chart is that when Nifty was at 6300 in Jan 2008 Rupee was at 39, when Nifty was again at 6300 on Nov 2010 Rupee was at 44! Which means if I were a foreign investor and I invested at the top in Jan 2008 I am still net negative in dollar terms! Around 12.5% to put an estimate. And suppose I had invested in the broader market, I am sure I would be still down 50%! Somehow if the markets start to sell off again these guys would be the first to throw in their towel for hyperventilation as they will have to face the equity as well as rupee sell off double whammy !!

The USD-INR weekly chart shown above is from March 2007 till date. Notice how Rupee strengthened till Oct-Nov of that year till 39 but then stabilized while the Nifty kept rallying. Even in January when the mini crash occurred it was well under 40. I personally cannot imagine such a crash in Nifty now without giving the exchange rate any resulting shock. Even a 100 point Nifty movement is accompanied with 30-50 basis points of movement in the exchange rate. How can an 1800 movement point be almost lost in the above chart? In my opinion the stock market and currency game were played in two different fields, also I cannot rule out RBI trying to stabilize the currency by intervening to give some respite to the exporters around that 40 levels before the mini crash in Jan and doing the opposite after it. (As it would have pledged to keep the exchange rate around 40).

But as we know that stock market mini crash was just the beginning and slowly and steadily global risk aversion was developing. After May 2008 Rupee started sliding as FIIs started selling their holding in India and other emerging markets which were considered risky assets as compared to US treasuries. This "sell" emerging market assets gained big momentum around Oct 2008 when Lehmann collapsed. Interestingly though Nifty made its low during this period, the carnage in broader market was still on. Which we see as the Rupee kept falling until it reached 52, almost a 33% fall in just over a year!

Then comes the phase where huge bailouts were announced and the Fed started printing dollars to save the US banks and much more (so dollar started losing value compared to other currencies). Apart from being highly oversold and shooting well below fair value, emerging assets also started looking attractive and since then we are still going strong with the rally in Rupee!

Now lets do some interpretation of this chart. The rally from 39 to 52 clearly looks to be a 5 wave. Also look at how rally from Dec 2008 to Mar 2009 forms a negative divergence, which is a very typical 5th wave property. Also note that the lows of Apr 2010 and Oct 2010 forms a positive divergence. Dollar also have rallied from 44 level, which interestingly is 62% Fibonacci retracement of the entire trend from 39 to 52.

If we look at the long term chart above we can clearly say it is in a long term uptrend. Which kind of makes me believe that the trend should continue. In the above chart see how from 2002-2003 dollar has lost its value while the stocks rallied from Nifty 1200 to 6300! Also note that it looks to be a 3 wave corrective pattern. Putting this in the back of mind I feel we are yet to see another strong rally in dollar compared to rupee which should take it above 52 to say the least.

Now all of know how this rally can impact stock markets. The fact that Rupee is going to weaken is not a concern, but the current structure of the currency market which blatantly says that dollar is a safe haven and emerging markets currencies are risky assets are. If this rally is to come, its going to be only on risk aversion, where all assets apart from Dollar will be painted with the same brush.

Another point to note on the first chart is that when Nifty was at 6300 in Jan 2008 Rupee was at 39, when Nifty was again at 6300 on Nov 2010 Rupee was at 44! Which means if I were a foreign investor and I invested at the top in Jan 2008 I am still net negative in dollar terms! Around 12.5% to put an estimate. And suppose I had invested in the broader market, I am sure I would be still down 50%! Somehow if the markets start to sell off again these guys would be the first to throw in their towel for hyperventilation as they will have to face the equity as well as rupee sell off double whammy !!

04 December 2010

Nifty : Popgun Shot?

Few months back I came across an interesting candle formation which by its author was called popgun. Popgun is essentially a toy gun which has its bullet attached to the gun itself by a string. When you shoot, the bullet fires ahead but after travelling the distance equal to the length of the string, gets pulled back to the shooter!

This popgun formation can be identified by 2 candles. First would be an inside candle and the second an outside. Which means the 1st candle would be completely within the shadow of its preceding candle and also completely within the candle that follows it.

The significance of this pattern is that prices will breakout from the range and move a good amount and then retrace "significantly". The definition of significantly is definitely not quantifiable but in my opinion a 50% should be the minimum.

Lets see this in action.

You can see how Nifty futures of December expiry makes this same pattern right at the bottom of this correction which is around 5700. Prices then rally but looks like losing steam around 6000 levels. If one is to believe this candle formation we should see prices falling back significantly closer to 5700 levels or maybe even lower!

My conviction increases due to the fact that not only nifty but their are many banking and material stocks that are also showing this pattern. To name a major few that I came across are Axis Bank, Andhra Bank and HDFC Bank, Indian Overseas Bank, Hindalco and Hindustan Zinc!

Now to add a bit of food for thought to it, please check the monthly chart below and also the same pattern right at the beginning of the year 2009 !! What should happen if this popgun materializes?

This popgun formation can be identified by 2 candles. First would be an inside candle and the second an outside. Which means the 1st candle would be completely within the shadow of its preceding candle and also completely within the candle that follows it.

The significance of this pattern is that prices will breakout from the range and move a good amount and then retrace "significantly". The definition of significantly is definitely not quantifiable but in my opinion a 50% should be the minimum.

Lets see this in action.

The weekly chart of nifty here shows 2 instances of it. First after the january crash nifty forms this popgun pattern and then falls to 4500 level, but as this pattern was made in the range of 5000-5500 after going to 4500 it comes back to the same level where it formed the pattern!

Next one is almost at the end of 2008 when nifty forms the same pattern around 2500-2800 range, rallies to over 3200 and then return back to the same level!

Interesting isn't it? And definitely worth more study. So why not track this pattern real time? Below is the daily chart of Nifty futures as of now.

My conviction increases due to the fact that not only nifty but their are many banking and material stocks that are also showing this pattern. To name a major few that I came across are Axis Bank, Andhra Bank and HDFC Bank, Indian Overseas Bank, Hindalco and Hindustan Zinc!

Now to add a bit of food for thought to it, please check the monthly chart below and also the same pattern right at the beginning of the year 2009 !! What should happen if this popgun materializes?

Breadth Indicator : Week Ending 03 Dec 2010

Above is the distribution of stocks in their respective "deciles". If it is compared to the chart of the week ending Nov 26 we can see a gradual shift in the concentration from -70% to -40%. Nifty experienced an oversold bounce and so did a lot of beaten down stocks. There needs to be a lot of work done by the broader market to get back to shape, the ideal one should be when the peak is made in the positive territory and then only we can say that the market is recovering and has the potential to rally higher.

The weakest stocks are :

GTL

JSWSTEEL

SCI

VIDEOIND

WELCORP

The strongest are:

DISHTV

DRREDDY

TCS

CIPLA

TATAMOTORS

28 November 2010

Sectors of Correction

Nifty's last swing closing high was made on November 5th 2010. Since then Nifty has fallen just under 9% as of 26th November 2010. But the damage done to Market breadth has been immense. I have been posting a lot on breadth, lets take a look at the broader market (stocks trading in F&O segment) with a sectoral point of view.

The above table and chart shows how the different sectors have faired. No award for guessing the weakest sector! The other bigger sectors like Power, Infrastructure and Materials have also not faired well. Most striking to see was Financials losing 16% since the peak on Nifty! Looks like the sector that rallied the most has also not been spared in selling.

Auto, Healthcare, FMCG and IT has resisted the selling. We need to keep an eye in case these start getting sold.

The above table and chart shows how the different sectors have faired. No award for guessing the weakest sector! The other bigger sectors like Power, Infrastructure and Materials have also not faired well. Most striking to see was Financials losing 16% since the peak on Nifty! Looks like the sector that rallied the most has also not been spared in selling.

Auto, Healthcare, FMCG and IT has resisted the selling. We need to keep an eye in case these start getting sold.

27 November 2010

Nifty : Cloudburst ?

After consistent selling for 3 weeks, Nifty has lost 600 points. Though 600 points is not a big deal the major impact has been on sentiments. All the TV analysts who were predicting 6500-7000 in a matter of weeks are quickly doing a U turn and talking about this being another good opportunity to buy! Well definitely we can get a bounce, maybe a sharp one as I feel there has been a lot of pessimism very quickly and kind of fear as well. Also data suggests there has been a lot of short addition and market do not like crowd one side.

The above chart shows Nifty along with MACD and Oscillator. We have overlays of 50dma, 200dma and Ichimoku clouds. As we see Nifty has broken 50dma, week before last itself and the cloud support on friday last week. The MACD shows no sign of divergence, rather its gaining momentum and the oscillator shows very oversold levels.

Now what we can infer from all these is that after breaking 50dma a very natural attraction towards 200dma can happen. We would have expected Nifty to give a fight at the clouds but looks like the clouds are far too weak to stop the downside momentum. The oscillator though a very bad indicator in a trending market, points to some kind of technical rally.

What I feel is that with some days of no bad news day we can see that technical rally materialize. It should be contained around the 5950 area. The pessimism will certainly erode and so should the shorts. But as the overhang of scam, Euro crisis and all other "news" again make headlines, market will rapidly fall to test the 200dma around 5500.

The other scenario can be no respite from all these and a selling party for next 10 days as well, where we hit 200dma and then bounce hard (maybe) to current levels. Whatever be the case next week should be eventful and volatile. Making money would certainly be never easy as it had been.

The above chart shows Nifty along with MACD and Oscillator. We have overlays of 50dma, 200dma and Ichimoku clouds. As we see Nifty has broken 50dma, week before last itself and the cloud support on friday last week. The MACD shows no sign of divergence, rather its gaining momentum and the oscillator shows very oversold levels.

Now what we can infer from all these is that after breaking 50dma a very natural attraction towards 200dma can happen. We would have expected Nifty to give a fight at the clouds but looks like the clouds are far too weak to stop the downside momentum. The oscillator though a very bad indicator in a trending market, points to some kind of technical rally.

What I feel is that with some days of no bad news day we can see that technical rally materialize. It should be contained around the 5950 area. The pessimism will certainly erode and so should the shorts. But as the overhang of scam, Euro crisis and all other "news" again make headlines, market will rapidly fall to test the 200dma around 5500.

The other scenario can be no respite from all these and a selling party for next 10 days as well, where we hit 200dma and then bounce hard (maybe) to current levels. Whatever be the case next week should be eventful and volatile. Making money would certainly be never easy as it had been.

Breadth Indicator : Week Ending 26 Nov 2010

As mentioned in the breadth indicator post last week the Nifty took a battering and so did the breadth. The current breadth chart has been made on December series data which starts from 1st of October when the nifty closing was at 6150. Last closing of Nifty has been on 5750, a 400 point cut.

The breadth has turned negative in an extreme way, not that it was good during the rally, but 142 stocks out of 193 showing a reading of -50% or less is certainly a sign of weakness.

We have seen sharp and swift correction and very obviously expectations are building up for a bounce.

The way to play a bounce can be to go long the most beaten down stock (HCC, RELINFRA and RCOM) or the strongest stocks (DRREDDY and HEROHONDA).

Though expectation of a bounce are building up market never does oblige us, more bad news and FII selling (which has only just started) can easily make look you stupid and impatient.

The breadth has turned negative in an extreme way, not that it was good during the rally, but 142 stocks out of 193 showing a reading of -50% or less is certainly a sign of weakness.

We have seen sharp and swift correction and very obviously expectations are building up for a bounce.

The way to play a bounce can be to go long the most beaten down stock (HCC, RELINFRA and RCOM) or the strongest stocks (DRREDDY and HEROHONDA).

Though expectation of a bounce are building up market never does oblige us, more bad news and FII selling (which has only just started) can easily make look you stupid and impatient.

21 November 2010

Max Pain : November Series

Max Pain on Nifty Options is suggesting an expiry closer to 6000. We need to track if 6000 PE and 5900 PE is losing Open Interest. If that happens, chances are of Nifty moving sharply lower from current level of 5890.

Breadth Indicator : Week Ending 19 Nov 2010

We can see breadth has swiftly deteriorated along with deep cut in Nifty. See Earlier Post for it as well as details to interpret the chart.

The current state of breadth has nothing convincing about it, all we can expect is some kind of oversold bounce.

20 November 2010

Nifty : Long term View

Wanted to share long term technical picture of Nifty. Please see the chart below, which is a log scaled Nifty chart from middle of 1994, didn't had data so will try to base my findings on whatever I can get hold of.

What we see till 1999 is a very range bound market, and after that a significantly strong rally for a year. I have labelled the Elliot wave counts and would be glad to receive comments on it. And if I am correct, predicts a disastrous correction after the end of the ongoing 5th wave (some signs are there that it may already have ended but I will wait for some more confirmation signs).

How do I justify the count?

After the obvious first look 5 wave formation from 1999, we try to see if the other assumptions are satisfied.