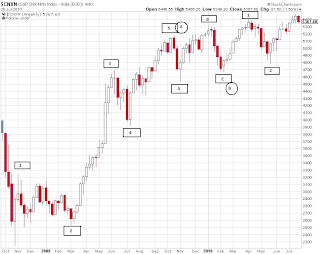

Check the above chart which shows the NIfty Futures, Nifty PCR and Total PCR all based on August Series data. Though the OI would be extremely low in early days the fact that both Nifty and Total PCR were between 0.2-0.4 (very low) were signals of a coming rally. Then we see both lines moving up together along with Nifty which surely was a sign of healthy rally ahead.

Around 28th june (first vertical) we see Nifty PCR accelerating its rise as compared to Total PCR while the markets went nowhere, definitely a sign of neutral to bullish expectations atleast on the Nifty.

Things get interesting from 8th july (second vertical) where Nifty rises modestly, Nifty PCR rises but the Total PCR drops! What could be happening? My guess would be that market participants started hedging there positions by writing stock and other index call options (which make the other part of the total PCR calculation). What made them do so, well it could be as simple as the fact that market again reached the resistance area.

Now see what is happening since july 19th, Nifty as well as Total PCR have started falling. though the Nifty made a new high in the meantime. Surely looks like the rubber band has been extended too far on one side and a fall is inevitable. This divergence of Nifty going higher and PCR going lower is a very strong signal of things being not that rosy! Smart money has started getting out if not already out.

Surely things can change suddenly and dramatically in a market, more so if its equity and that too of a relatively smaller size as that of India. But keeping an eye on market internals which without doubt is deteriorating will help you from burning fingers.