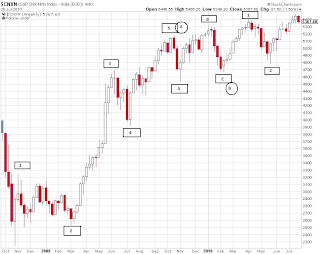

The bullish count currently places Nifty in a 3rd wave which may or may not have ended. This wave itself has the power to push Nifty to new all time high, but given the divergence and the inability to cross 5450 convincingly points rather to an end of wave 3. We can expect 4th wave to end around 5100 and then a final burst to 5500+ but not by a lot.

The divergence which has developed needs to be negated by an extremely strong upside pretty soon for the above mentioned possibility to change and for Nifty to take a shot at earlier highs.

Bearish Count :

The bearish count says that we are almost rather I should say finally done with the rally and all we can expect Nifty to do is move southwards. Note that this would be the end of a larger zig-zag upwards correction from the October 2008 lows and would mark the ultimate turning point, which CAN take Nifty to a lower low!

Both the above scenarios are based on the fact that January 2008 highs marked the end of a larger 5 wave structure and from that point Nifty is in a correction.

Scenario 1. It could be a zig-zag correction and Nifty can finally bottom around 1000-1250 range.

Scenario 2. It could be a triangle and Nifty may spend years in the range 2500 to 5000.

Scenario 3. It can also be an irregular correction where Nifty even after making a new high falls back rapidly to lower levels.

There are lots of moving parts and lot of factors that will guide where the stock market goes. India's economy though the most important factor has only a small weightage! Things will depend a lot on where the global economy is going, where the global debt issue is headed, what will happen to China which is looked upon to pull the world out of recession, which bubble will be added to list of bursts, what will happen when the currency printing stops, whether we enter hyperinflation or deflation leading into depression or miraculously we escape the punishment for the excesses we did by doing more of those!

Bearish Count :

The bearish count says that we are almost rather I should say finally done with the rally and all we can expect Nifty to do is move southwards. Note that this would be the end of a larger zig-zag upwards correction from the October 2008 lows and would mark the ultimate turning point, which CAN take Nifty to a lower low!

Both the above scenarios are based on the fact that January 2008 highs marked the end of a larger 5 wave structure and from that point Nifty is in a correction.

Scenario 1. It could be a zig-zag correction and Nifty can finally bottom around 1000-1250 range.

Scenario 2. It could be a triangle and Nifty may spend years in the range 2500 to 5000.

Scenario 3. It can also be an irregular correction where Nifty even after making a new high falls back rapidly to lower levels.

There are lots of moving parts and lot of factors that will guide where the stock market goes. India's economy though the most important factor has only a small weightage! Things will depend a lot on where the global economy is going, where the global debt issue is headed, what will happen to China which is looked upon to pull the world out of recession, which bubble will be added to list of bursts, what will happen when the currency printing stops, whether we enter hyperinflation or deflation leading into depression or miraculously we escape the punishment for the excesses we did by doing more of those!

0 comments:

Post a Comment